Tariff Management Mastery: Leveraging FTZs and Bonded Warehouses for Global Companies

Practical Approaches for International Firms to Mitigate U.S. Tariffs and Optimize Cash Flow

Navigating tariffs and unpredictable trade policies can be challenging for international businesses selling into the United States. Foreign Trade Zones (FTZs) and bonded warehouses offer strategic advantages to firms - regardless of their geographic origins - looking to manage tariff impacts, preserve liquidity, and maintain competitive market positions.

Why FTZs and Bonded Warehouses Matter to Global Companies

Companies from Asia, Europe, and other regions exporting goods to the U.S. face significant tariff pressures. Tools like FTZs and bonded warehouses help these firms store, assemble, or modify products duty-free, providing flexibility in cash flow and supply chain management.

Foreign Trade Zones (FTZs) defer customs duties until products exit the zone into U.S. commerce or are re-exported.

Bonded warehouses allow goods to be stored duty-free for up to five years, enabling companies to adjust to favorable tariff conditions.

Real-Life Examples of FTZ Utilization by International Firms

🔹 Automotive and Technology Industries

Global automotive manufacturers such as Toyota, Hyundai, and BMW utilize FTZs to assemble imported components in the U.S.

Benefit: Reduced overall tariff costs through the "inverted tariff" advantage, where lower duty rates are applied to finished products rather than individual imported components.

Result: Significant cost savings and streamlined production processes, maintaining competitiveness in the U.S. market.

🔹 Pharmaceuticals – Pfizer and COVID-19 Vaccine

European pharmaceutical giant Pfizer leveraged FTZs during the COVID-19 vaccine rollout.

Benefit: Imported vaccine components were exempted from immediate duties; storage was duty-free until FDA approval.

Result: Lower initial costs, improved supply chain agility, and rapid response capability.

🔹 Consumer Electronics – Sony and Samsung

Asian electronics leaders Sony and Samsung utilize FTZs extensively for assembling consumer goods within the U.S.

Benefit: Delayed duty payments and improved cash flow management.

Result: Enhanced operational flexibility and optimized timing for market entry and inventory control.

Bonded Warehouses: A Flexible Solution for Global Firms

Bonded warehouses provide an additional layer of tariff management flexibility:

Tariff optimization: Duties are paid only upon goods' entry into U.S. commerce; companies can leverage tariff reductions occurring during storage periods.

Cash flow management: Companies delay duty payments until the ideal market conditions or tariff reductions arise.

International Companies Leveraging Bonded Warehouses

A European furniture manufacturer stored inventory in bonded warehouses during a period of high U.S. tariffs, significantly reducing overall tariff payments when duties eventually decreased.

Asian fashion brands utilized bonded storage to adjust their inventory timing, reducing exposure to tariff volatility and aligning duty payments with market demand.

Choosing Between FTZs and Bonded Warehouses: A Strategic Decision

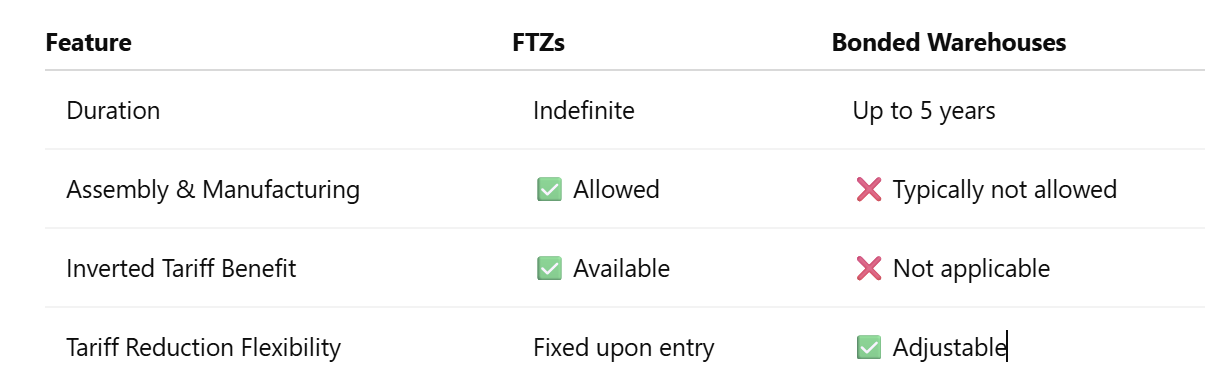

FTZs are ideal for firms manufacturing or assembling goods within the U.S., whereas bonded warehouses suit companies primarily looking to manage imported inventory efficiently without manufacturing processes.

Implementing FTZ and Bonded Warehouse Strategies

Evaluate Products – Identify which goods are most affected by U.S. tariffs.

Select the Right Facility – Match your needs: assembly and manufacturing activities fit best in FTZs, while pure storage solutions align with bonded warehouses.

Internal Coordination – Obtain necessary internal and external approvals swiftly to maximize the advantage of tariff management strategies.

Technology and Compliance Systems – Implement robust systems to track goods, manage customs requirements, and maintain compliance seamlessly.

Long-Term Advantages for International Businesses

FTZs and bonded warehouses offer substantial operational and financial advantages for non-U.S. companies entering or expanding in the U.S. market.

These tools help global firms mitigate tariff risks, manage liquidity, and strategically time market entry.

Explore how global companies are successfully navigating tariff challenges and connect with other international supply chain professionals at Chain.NET. Join insightful discussions, attend specialized events, and access exclusive resources tailored to international trade and procurement.